John & Susan's Story: Finding Confidence in the Next Chapter

When John and Susan Mitchell first came to True North Lifestyle, they were on the brink of retirement - financially comfortable, but emotionally uneasy.

After decades of hard work - John as a senior engineer, and Susan as a part-time highschool teacher - they had built a life they were proud of. Their Sydney home was paid off, their combined super balance stood at $1.3 million, and they owned an investment property and some shares.

Still, the thought of retiring filled them with quiet anxiety.

"Are we doing enough to make it last?" Susan asked.

"What if the market crashes just when we stop working?" John added.

Their concerns were deeply relatable - longevity risk, market volatility, and the fear of making a wrong move that could undo decades of careful planning. They worried about rising costs, healthcare needs, and how to make their money last without sacrificing their

lifestyle or ability to support their adult children.

Turning Uncertainty into a Plan

Through thoughtful conversations and a structured retirement income strategy, the True North team helped transform John and Susan’s uncertainty into clarity and control.

After meeting twice to deeply understand their goals, lifestyle preferences, and risk comfort, we conducted a comprehensive investment profiling exercise. This helped us design a low-risk, high-income portfolio capable of providing consistent cash flow - even

through market ups and downs.

We walked them through the super contribution rules and demonstrated how restructuring their investment property could help clear all remaining investment debt while still leaving surplus funds. By carefully calculating capital gains tax and applying a strategic contribution plan, we successfully offset the capital gains from their property sale.

This meant they could retain their family home, boost their tax-free super balances, and position their funds in a zero-tax retirement environment.

In parallel, we implemented an estate planning strategy to ensure their adult children would inherit assets efficiently, without unnecessary tax liabilities.

Our recommendations were modelled across multiple scenarios using our financial planning software - giving John and Susan visual clarity and confidence before any steps were taken.

The Results

Within 12 months, John and Susan:

- Saved over $40,000 in capital gains tax through strategic catch-up contributions.

- Established a sequencing-risk-proof portfolio with transparent, easily accessible investments.

- Removed over $119,000 in potential super fund death benefit taxes for their children.

- Created a clear, reliable income stream that supports their desired retirement lifestyle - including travel, family time, and giving back to the community.

All supported by yearly reviews and clear metrics to track progress and success.

One Year Later

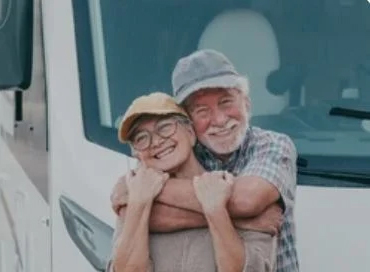

When we met again for their first annual review, John and Susan joined via Teams - from a caravan park in Northern Queensland.

They were travelling around Australia, stress-free and smiling. Their super funds were performing steadily, their income was stable, and they'd stopped checking the markets every morning.

Instead of worrying about what could go wrong, they were living what they'd always worked for: freedom, security, and peace of mind.

"We didn't just get a plan - we got confidence for life," John said.

Today, John and Susan know that no matter where life takes them, they're not on this journey alone. Whether it's a complex financial question or just a good admin enquiry, the True North team is always just a call or message away - ready to guide, support, and keep them on course toward the retirement they once only hoped for.