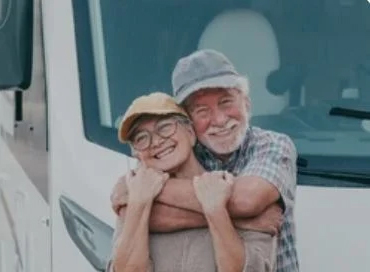

When this couple first came to us, they were unsure whether they had “enough” for retirement. They had worked hard their entire lives, but navigating super, investments, and long-term planning felt overwhelming.

We walked them through a complete retirement strategy - optimising their superannuation, restructuring investments, and building a clear roadmap for sustainable income.

Today, they’re living the lifestyle they dreamed of: financially secure, confidently retired, and enjoying the freedom to spend time on what matters most.